In today’s fast-paced world, financial planning has become more crucial than ever, especially for millennials. This generation faces unique challenges such as student loan debt, rising living costs, and uncertain job markets. Financial Advisors’ Advice for Millennials Thus, seeking advice from financial advisors can significantly impact their financial well-being. Finding the Right Financial Advisor Finding […]

Month: March 2024

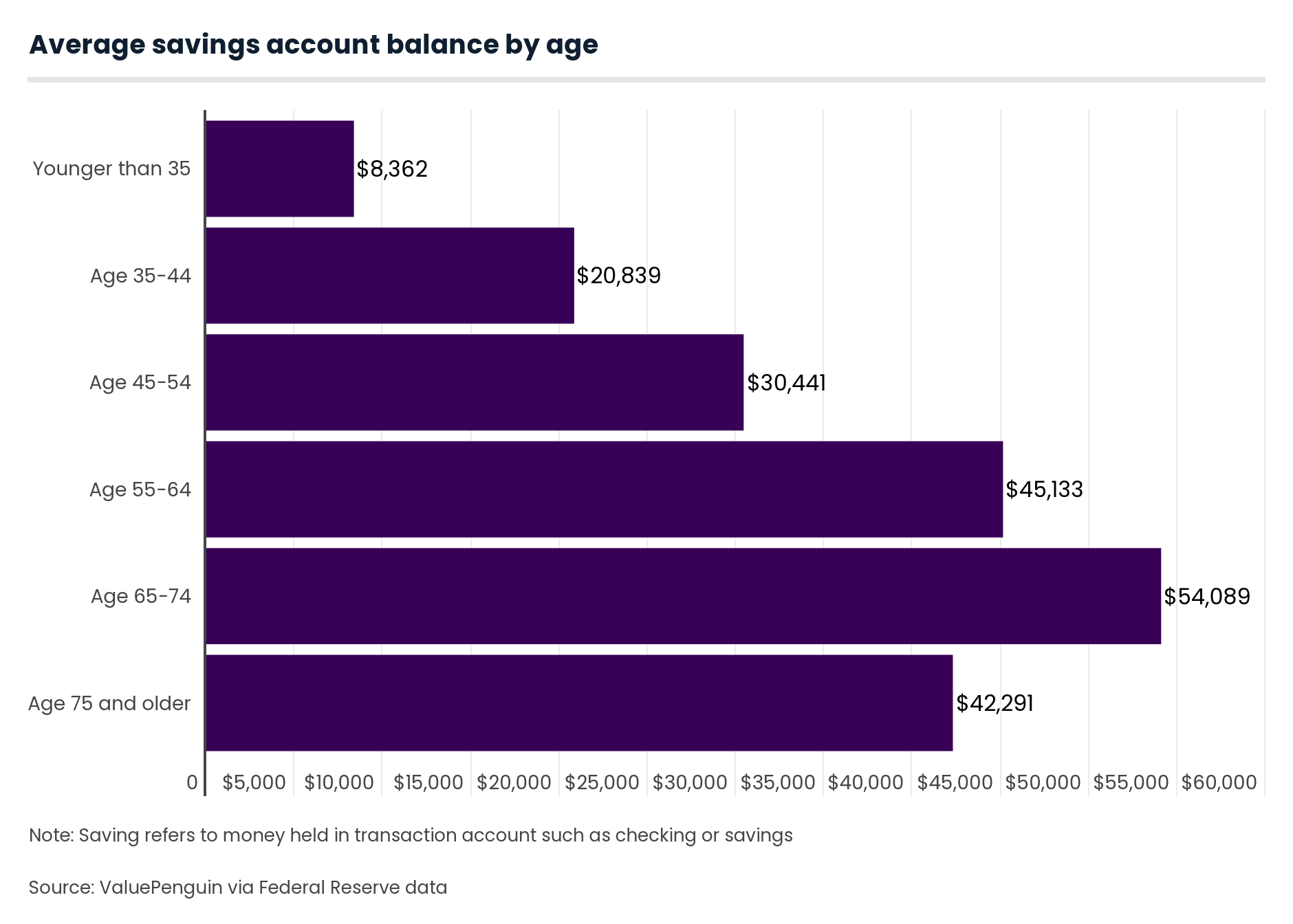

Average Savings by Age

Understanding the concept of average savings by age is crucial for anyone looking to secure their financial future. It involves examining the typical amount individuals save at different stages of life, from their early twenties to retirement and beyond. Saving habits evolve as people progress through life, influenced by various factors such as income, expenses, […]

Employee Loan: What It Is and Should You Get One?

In today’s fast-paced world, unexpected financial emergencies can arise at any moment. To address such situations, many companies offer employee loans as part of their benefits package. Employee Loan: What It Is and Should You Get One? Employee loans, also known as salary advances or payroll loans, are essentially short-term loans provided to employees by […]

What Is Inland Marine Insurance?

Inland marine insurance is a specialized form of insurance coverage designed to protect goods, equipment, and materials while in transit over land or while stored at various locations away from a company’s primary premises. Unlike traditional property insurance. Inland Marine Insurance Which primarily covers assets at fixed locations, inland insurance provides coverage for property that […]

What Is an IRA CDs?

Individual Retirement Account Certificates of Deposit (IRA CDs) serve as a unique and secure investment option for individuals planning for retirement. In this article, we’ll delve into the nuances of IRA CDs, exploring their workings, benefits, types, and considerations for choosing and managing them effectively. What is IRA CDs? Retirement planning often involves a mix […]

How Many Savings Accounts Should I Have?

Saving money is a crucial aspect of financial stability and achieving long-term goals. However, when it comes to managing your savings, one common question arises: Savings Accounts Should I Have How many accounts should I have? While the answer varies depending on individual circumstances, there are several factors to consider when deciding the number of […]

Does Insurance Cover Service Dogs?

Service dogs play an invaluable role in the lives of individuals with disabilities, providing them with assistance, companionship, and independence. However, the costs associated with owning and caring for a service dog can be significant. Many people wonder whether insurance can help alleviate some of these financial burdens. Does Insurance Cover Service Dogs? In this […]

How FAFSA Works A Quick Guide

Navigating the world of financial aid for college can be overwhelming, but understanding how FAFSA works is crucial for students seeking assistance in funding their education. How FAFSA Works A Quick Guide FAFSA, or the Free Application for Federal Student Aid, serves as the gateway to various forms of financial aid, including grants, loans, and […]

6 Simple Tips to Setting Financial Goals for Your Future

Financial stability and security are crucial aspects of a fulfilling life. While many people understand the importance of setting financial goals, they often struggle to translate their aspirations into actionable plans. In this comprehensive guide. Setting Financial Goals for Your Future We’ll go into 6 simple yet effective tips for setting and achieving your financial […]

Budgeting for a New Baby: Ongoing and One-Time Expenses

Budgeting for a new baby requires meticulous planning and foresight to ensure financial stability during this exciting yet expensive phase of life. Ongoing and One-Time Expenses From one-time expenses to ongoing costs, understanding the financial implications of having a baby is crucial for new parents. Let’s delve into the various aspects of budgeting for a […]